Changing Mortgage Rates Impact Your Budgets

It was projected that we would see an increase in mortgage rates rise this year. In comparison to historical data, the mortgage rates are still incredibly low (think in the 1980’s it was at 12% and in the 2000’s it was 6.29%) but the interest rate can definitely affect what you can afford when purchasing a new home. Home prices are continuing to increase while interest rates are as well. We still see bidding wars and cash-buy offers, so there is no indication that the housing market will be decreasing anytime soon according to real estate professionals and economists.

Interest rates in the United States are determined by the actions of the U.S. Federal Reserve, the health of the economy and other factors. You’ll need to consider that the cost of mortgages is closely tied to interest rates, the price of the homes sold oftentimes do not directly correlate. It is a fine balancing act.

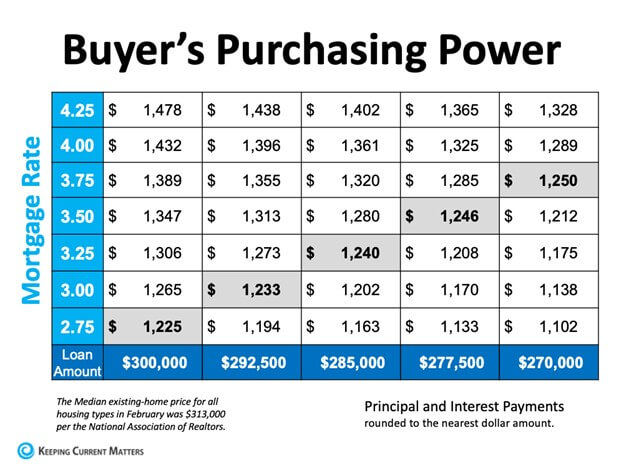

As we mentioned in previous blog posts, a decrease in interest rates usually allows for your dollar to stretch a bit more depending on your credit score and mortgage rate eligibility. Purchasing a home is not a decision that you take lightly, and your budget is very important. As interest rates increase, the loan amount would decrease in order for you to stay within your budget. Reversely, if interest rates decrease, your homebuying budget would increase.

It is still an opportune time to purchase a home as the rates are still historically low in comparison to previous years. As these conditions are favorable now, it is more crucial than ever to reach out to a local real estate professional to start the homebuying process while your purchasing power is still strong.

All information provided in this publication is for informational and educational purposes only, and in no way is any of the content contained herein to be construed as financial, investment, or legal advice or instruction. CrossCountry Mortgage, LLC (“CrossCountry”) does not guarantee the quality, accuracy, completeness or timelines of the information in this publication. While efforts are made to verify the information provided, the information should not be assumed to be error free. Some information in the publication may have been provided by third parties and has not necessarily been verified by CrossCountry.